Pension members

Pension members - this section is just for you. Here you will find information to help you manage your pension and enjoy your retirement.

When is your pension paid?

Pension payments are due every second Thursday.

Our pay day calendar can help you keep track of when your pension is paid.

Pay day calendar

You can download a copy to print, or a version to import into the calendar on your phone or computer.

Consumer Price Index (CPI) increases

The All Groups Consumer Price Index (CPI) number is declared by the Australian Bureau of Statistics (ABS). The CPI is a measure of the increase and/or decrease in the weighted average of prices for a number of goods recorded in Australia's eight capital cities for categories of household expenditure.

The ESSSuper pension CPI increase is calculated twice each year in accordance with the State Superannuation Act (the Act) 1988. When calculating each pension CPI increase, the Act requires that we use the most recent CPI (June or December) and the previous highest half-yearly CPI index number. Please refer below for more details of how CPI increases are calculated.

On the first pension pay day in June and December each year we adjust your pension payments in line with any increase in the CPI calculated in accordance with the Act. Negative CPI changes are not applied to your pension.

If your pension started during the previous period you may receive a partial, pro-rata pension CPI increase to your pension. An increase may not be applied to pensions started after the previous period.

About the latest pension CPI increase

- CPI rate: 2.22%

- Effective from: 24 November 2023

- Applied on pay day: 7 December 2023

- For the period: 1 January 2023 to 30 June 2023

Pro-rata increases

| Month pension started |

Fraction of rate applied |

Actual increase applied |

| January 2023 (or before) |

6/6 |

2.22% |

| February 2023 |

5/6 |

1.85% |

| March 2023 |

4/6 |

1.48% |

| April 2023 |

3/6 |

1.11% |

| May 2023 |

2/6 |

0.74% |

| June 2023 |

1/6 |

0.37% |

| July 2023 (or after) |

0/6 |

0.00% |

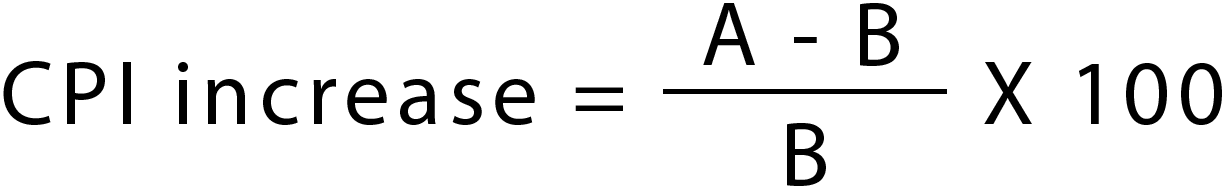

The formula used to calculate the percentage increase to pensions is determined by Section 91 of the State Superannuation Act (the Act) 1988:

In this formula:

- A = The most recent half-yearly All Groups CPI index number declared by the ABS

- B = The previous highest half-yearly All Groups CPI index number declared by the ABS

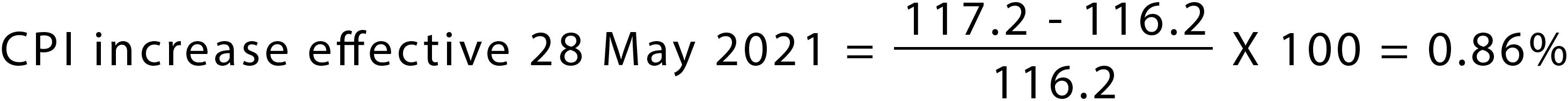

Example: The CPI increase effective 28 May 2021

The index numbers relevant to the CPI increase effective from 28 May 2021 have been collated in the table below:

| Half-yearly period |

All Groups CPI number (weighted average of eight capital cities) |

| December 2020 |

117.2 |

| June 2020 |

114.4 |

| December 2019 |

116.2 |

| June 2019 |

114.8 |

As the CPI index number for December 2019 is higher than the CPI index number for June 2020, we have to use the December 2019 index number in our calculations.

Using the formula above:

Please contact us for further information, such as historical CPI increases.

Are you enjoying your retirement?

Moving into retirement is a big change! Some people love it, but you may be finding it tricky to adjust.

Whether you have taken to retirement easily, or whether you are finding it challenging, you should read through our Retirement Life Stages section. This section is based on research of our members, and describes four distinct life stages throughout retirement.

We have gathered some information and suggestions to help you make the most of each retirement stage. The information is not just about your finances, but your health and wellbeing too - the most important part of your retirement lifestyle.

Retirement life stages