Quarterly investment update - September 2020

ESSSuper - 30 Sep 2020

Daniel Selioutine, Head of Investments, takes the opportunity to review market activity and the Fund's performance.

Overview

The third quarter of 2020 has been a stark reminder to investors about how volatile global markets can be in times of high uncertainty. Following a strong end to the financial year, equity markets continued their bullish run in July and August before correcting in September. The ‘start-stop’ nature of global economic re-openings and persistently high Coronavirus case numbers continue to create uncertainties about the timing of an eventual recovery in economic activity. In the months ahead, investment markets will likely turn their focus on the U.S. presidential election, which is taking place in early November 2020.

Market performance

Monetary policy authorities around the world continue to hold interest rates at very low levels, closely monitoring indicators of economic activity before deciding on appropriate next steps. The U.S. Federal Reserve took steps to support markets by changing their policy framework to permit inflation to rise above targeted levels for periods of time. The revised approach would permit the U.S. Fed to delay rising interest rates if inflation overshot other indicators of economic health (such as unemployment and wages). At its September meeting, the Reserve Bank of Australia (RBA) decided to keep Australia’s cash rate target at its lowest level in history (0.25%), citing high unemployment and subdued growth in aggregate demand. Positively however, Australian economic activity had rebounded slightly faster than the RBA initially expected in the aftermath of the Coronavirus outbreak, boosted by government wage support.

Surveys of the manufacturing sector showed a recovery in activity in the U.S., Asia and the Eurozone. Non-manufacturing sectors such as hospitality and some services businesses continued to operate at depressed levels across much of the developed world. China is one of the few nations reporting consistently strong growth in activity across both its manufacturing and services sectors. Business and consumer confidence continue to improve from their March / April lows, although the pace of improvement is gradually tapering off.

U.S. equity markets have enjoyed a period of strong growth since the initial drawdown in March 2020, led by technology giants and large pharmaceutical companies working on Coronavirus vaccines. The “V-shape” recovery in equity markets has been supported by unprecedented policy response from central authorities. Markets slightly corrected in the month of September, with the S&P 500 losing 3.8% (USD) against the backdrop of increased uncertainty surrounding the U.S. presidential election. The FTSE 100 and ASX 300 also ended the month lower, declining 1.5% (GBP) and 3.6% (AUD), respectively.

Bond yields fell slightly lower, resulting in the Barclays Global Aggregate Index (Hedged into AUD) appreciating 0.7% over the quarter. Australian cash returned 0.3% over the calendar year, with cash returns decreasing over the past twelve months as central banks move to stimulate the economy.

Accumulation Plan performance

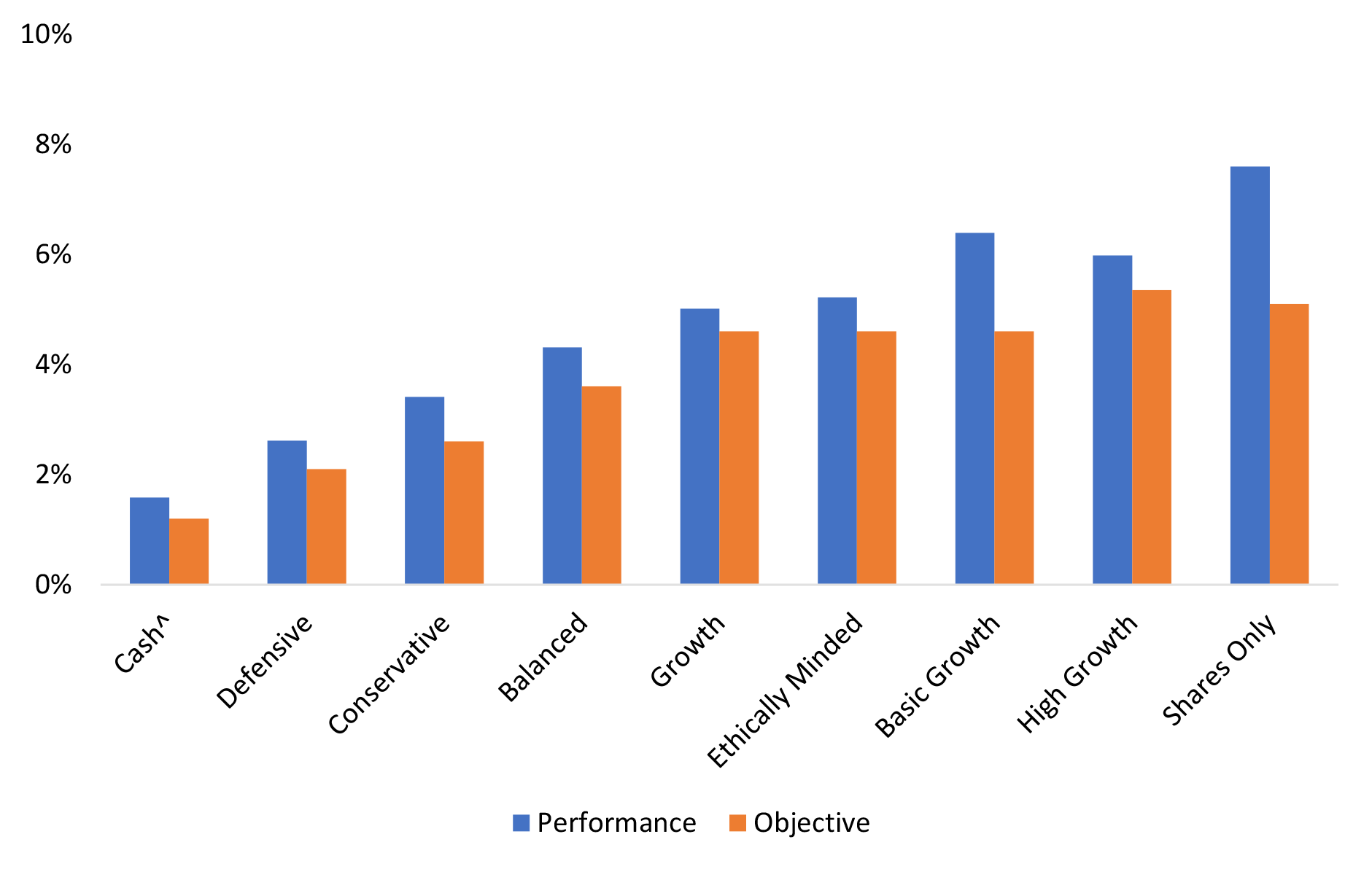

All of the Accumulation Plan's Investment Options generated positive returns over three years to September 2020, exceeding their investment objectives.

ESSSuper Accumulation Plan investment option performance

Three years to September 2020 (net of tax, net of fees)